Preventative Care

When we’re talking about pet insurance, preventative care describes treatments, services, or procedures that promote your pet’s health and maintain their general wellness, to help keep them healthy.

What is preventative care for a dog or cat?

Preventative care for your pet includes a wellness visit, which gives your vet the chance to screen for things like parasites or heartworm, or identify any early-stage health issues.

There are also proactive treatments, procedures, and prophylactics (like vaccines, flea and tick medication, heartworm prevention, and dental cleanings) that can help keep your pet from getting sick in the future. These tend to save you money in the long run, since reactive treatments are usually more expensive than proactive ones.

Wellness exams also allow your veterinarian to monitor your pet’s diet, their physical activity, their weight, and more. But keep in mind that not all treatments that promote your pet’s health will be covered by your pet insurance.

What do basic pet insurance plans cover compared to preventative care?

A basic pet insurance policy will help cover the costs of emergency care and standard treatments for your pets, but most accidents and illness insurance plans don’t include preventative care in a base policy.

Certain pet insurance companies will give you the option to customize your coverage by adding preventative care, helping reimburse you for the costs of some routine care.

Think about how much you pay for things like heartworm tests, vaccinations, wellness checkups, fecal tests, and bloodwork. Or how much puppy and kitten care procedures like microchipping, spaying/neutering and vaccinations cost. You’re probably already paying more for your pet’s medical care and annual wellness visits than coverage for preventative care would cost.

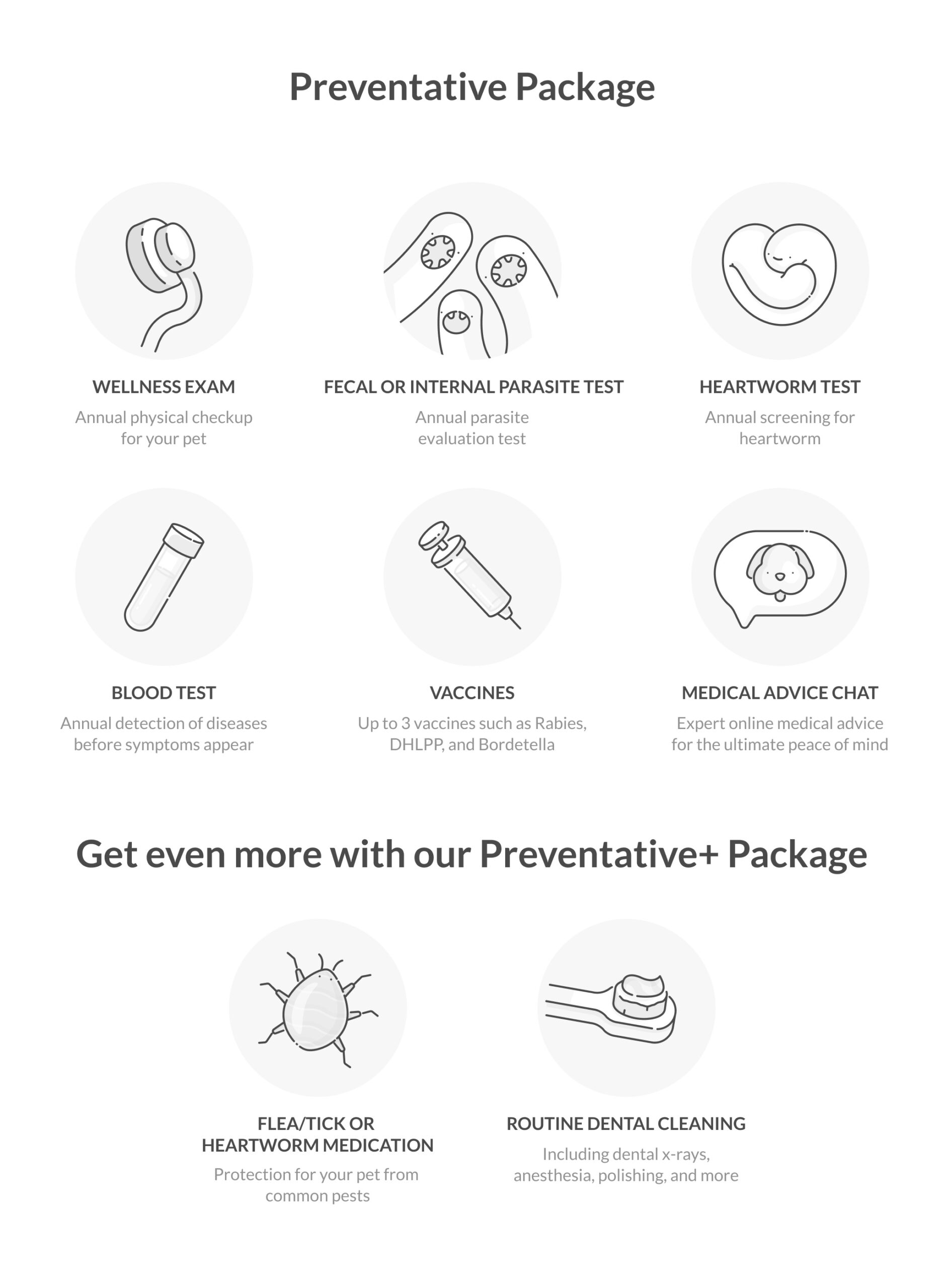

Here’s what the Lemonade pet health Preventative packages cover:

Don’t forget that a base accident and illness policy will cover a lot of your pet’s unexpected needs (like x-rays, medication, and surgeries for an eligible accident or illness).

Here’s the TL;DR of how Lemonade’s Preventative and Preventative+ care packages can help keep your pet covered:

Preventative Care

Here’s what can be covered as a part of our Preventative Care Package*:

- 1 Wellness Exam – Up to $50/yr

- 1 Fecal or Internal Parasite Test – Up to $35/yr

- 1 Bloodwork – Up to $65/yr

- 3 Vaccines – Up to $75/yr

- 1 Heartworm or FeLV/FIV Test – Up to $40/yr

*based on 80% co-insurance

Preventative+ Care

- 1 Wellness Exam – Up to $50/yr

- 1 Fecal or Internal Parasite Test – Up to $35/yr

- 1 Bloodwork – Up to $65/yr

- 3 Vaccines – Up to $75/yr

- 1 Heartworm or FeLV/FIV Test – Up to $40/yr

- Flea/Tick or Heartworm Medication – Up to $65/yr

- Routine Dental Cleaning – Up to $150/yr

*based on 80% co-insurance

Puppy/Kitten Preventative package

If your furry friend is under 2 years-old, we’ve designed the Puppy/Kitten Preventative package for puppies and kittens, made especially to provide young pets with the care they need to stay healthy.

It includes coverage for 2 wellness exams, 6 vaccines, 2 fecal or internal parasite tests, spay/neuter, microchipping and heartworm or flea/tick medication. Basically, all the major things your pup or kitten needs to grow to be a healthy adult!

Here’s the TL;DR of how Lemonade Pet’s Puppy/Kitten Preventative Care Package can help your pet covered:

- 2 Wellness Exams – Up to $100/yr

- 2 Fecal or Internal Parasite Tests – Up to $70/yr

- 1 Bloodwork – Up to $65/yr

- 6 Vaccines – Up to $150/yr

- 1 Heartworm or FeLV/FIV Test – Up to $40/yr

- Flea/Tick or Heartworm Medication – Up to $65/yr

- Spay/Neuter Procedure – Up to $120

- Microchip – Up to $40

*based on 80% co-insurance

What do pet preventative plans not cover?

Different insurance companies will have different coverage options for any preventative care plans they offer. In most cases, grooming or nail trims won’t be included in your pet insurance coverage, even though they technically are preventative care, since they keep your pet healthy.

Some pet parents might want to include additional items like teeth cleanings, physical therapy or behavioral treatments, so they should double-check their pet insurance policy to know exactly what they’re covered for and what’s not covered.

Is preventative care important for pet insurance?

If you’re committed to doing everything you can for your pet’s health, you’ll likely want to consider a preventative care option to add to your cat insurance or dog insurance. Your pet’s preventative care can provide you with peace of mind—especially if your pet is still young, preventative care can prevent health issues that show up as they mature.

Routine checkups and general preventive care are especially important for cats and dogs, since our pets tend to hide signs of illness or injury. Your furry friend can’t tell you if something’s wrong, so you’ll probably have a harder time noticing if they’re suffering from something a simple deworming could fix.

Regular vet visits will also give your vet a better understanding of your pet’s habits, general health, and temperament. And if your pet gets a bit anxious, these wellness exams can help create a sense of familiarity to help reduce the stress of future vet visits.

As a pet parent, your first job is to make sure your pet is being more than adequately taken care of. But it’s important to understand that pets will live healthier and happier lives when they’re taken to the vet on a regular basis– not just when something is clearly wrong with them.

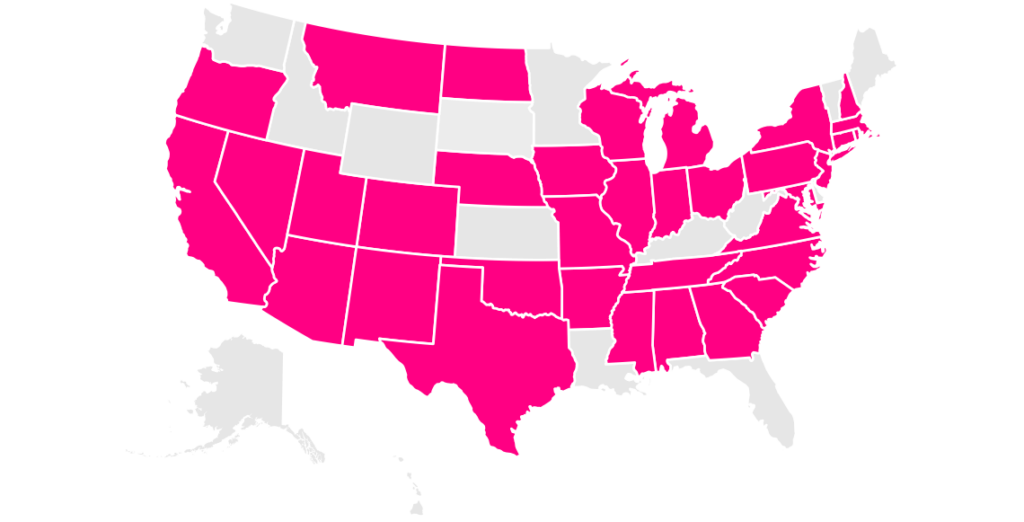

Which states currently offer pet health insurance?

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.