Getting renters insurance is a smart adulting decision. It’s the best defense against things in life you have no control over – like your phone getting stolen on the subway or your apartment flooding because your neighbors left their faucet on.

So if you ever face these headaches, you’ll be able to stay cool as a cucumber because, hey, you have renters insurance.

So the question isn’t whether or not you need renters insurance, it’s how much of it you need.

Your coverage needs won’t be the same as your best friend’s or neighbor’s. Your policy is unique to you, based on your lifestyle – If you just Marie Kondo’d your apartment, you’ll have far less stuff than your hoarder friend.

So how do you figure out how much coverage you need?

Your policy has a few main categories. To figure out how much renters insurance to get, you’ll need to choose coverage amounts for each category.

Figuring out the right coverage amounts can be tricky, so we asked people with Lemonade renters insurance how they selected theirs.

Here’s an overview of what we’ll cover:

1. How much personal property coverage do I need?

2. How much loss of use coverage do I need?

3. How much personal liability coverage do I need?

4. How much medical payments to others coverage do I need?

How much personal property coverage do I need?

Personal property coverage is protection for your stuff, like your phone, watch, couch, and bike – it protects you from things like theft, fire, and vandalism, both inside and outside your home.

How much can I get?

Between $10,000 and $250,000.

How much do I need?

We all accumulate so much ‘stuff’ over the years – how are you supposed to remember how much your entire living room cost you?

We asked Lissette, a renter in NYC, how she decided how much personal property coverage to get:

“I chose $20,000 worth of personal property coverage by estimating how much support I’d need if I had an emergency situation. What are the things I’d really need to replace? I also made sure this aligned with what I was comfortable paying monthly for a premium.’’

In other words, Lissette figured that if the absolute worst-case scenario happened – say, an apartment fire destroyed her things – she’d need $20,000 to replace her stuff.

Lemonader Lisa, a chef in NYC, decided to get $50,000 worth of personal property coverage:

“My sister was hit hard by Hurricane Sandy in NYC, so it was really important to her that I get a renters insurance policy. Initially, I shot really low with my coverage. And then my sister made me assess what I truly had and the value these things carry.”

Bottom line: Choose your coverage amount based on how much stuff you have and how much it would cost to replace them.

Btw, if you need coverage for your big-ticket items, such as your jewelry or fine art, you’ll want to look into our Extra Coverage (also known as scheduled personal property coverage).

How much loss of use coverage do I need?

Loss of use covers your temporary living expenses if you’re ever forced out of your home. So if a fire wreaks havoc on your apartment, it can help cover the costs of a hotel room and any additional expenses (such as food, laundry, etc).

A couple of notes about loss of use coverage with Lemonade:

1. It’ll change depending on what you choose for your personal property coverage. Usually, your loss of use coverage will be about 30% of your ‘stuff’ coverage. However, if you decide you need more loss of use coverage, you can always increase it (just not decrease)!

2. Loss of use only covers extra living expenses in the event of a loss. So if you typically pay $1,000/month on rent, and you have to relocate to a hotel that costs $1,500/month, your insurance will cover that extra $500 for you.

How much can I get?

Between $3,000 and $200,000.

How much do I need?

This category is a tough one. How on earth should you decide how much coverage you’ll need if your home becomes unlivable?

Mischa, a sales director from NYC, decided to go with $8,000 worth of loss of use coverage:

“I went with what would feel substantial enough in the event of a loss. I thought about how much I’d need in the worst case scenario”

Bottom line: When choosing your loss of use coverage, consider all of the expenses you could rack up beyond your normal daily budget (such as a place to stay, food, laundry, your commute, etc) if your home becomes unlivable for an extended period of time.

How much personal liability coverage do I need?

If someone gets hurt on your property and decides to take legal action, your personal liability will cover damages you’re legally required to pay.

How much can I get?

Between $100,000 and $1,000,000.

How much do I need?

Unless you have a crystal ball into the future, it’s not easy to determine how much personal liability coverage to get. Your landlord might have a specific coverage request – or you might be on your own to decide.

Lemonader Jessica from Oakland, CA chose $500,000 worth of personal liability coverage after her landlord requested that amount. Meanwhile, Miguel, an IT specialist for an aerospace company, said:

“I chose a high limit, $500,000, to protect myself for any liability. I live in a condo with surrounding neighbors so gotta protect myself.”

Bottom Line: For personal liability, coverage will start at $100,000, which means your insurance company will pay up to $100,000 in legal fees, medical bills, or damages per claim. You might need to check with your landlord or your building association to see if there are any specific requirements for your personal liability coverage.

How much medical payments to others coverage do I need?

If a neighbor or guest gets injured on your property, you’ll have this amount of money to cover their medical expenses.

How much can I get?

Between $1,000 and $5,000.

How much do I need?

You may have noticed that your personal liability coverage will protect you if anyone gets hurt on your property. However, medical payments coverage is a quick way to pay small medical bills for people hurt on your property — without getting lawyers involved.

Eric, a freelance illustrator from Arizona, chose $5,000 worth of medical payments coverage:

“Since my premium didn’t increase too much to get this coverage, I thought it was important to pay a small amount up front to have the comfort of knowing if someone got hurt on my property, I’d be able to voluntarily help out with some of their medical expenses.”

Bottom Line: Think about it this way: if someone injured themselves in your home, would you be able to cover medical or legal bills if they decided to sue you? These kind of events can be pretty pricey, so don’t underestimate your coverage needs — especially since renters insurance is so affordable. Curious about the price? Learn how much is renters insurance.

Change your coverage amounts any time

With life busier than ever, we need businesses to adapt to our fast-paced lives. With Lemonade’s first ever live insurance policy, Lemonade customers can make changes to coverages and more, whenever and wherever they are.

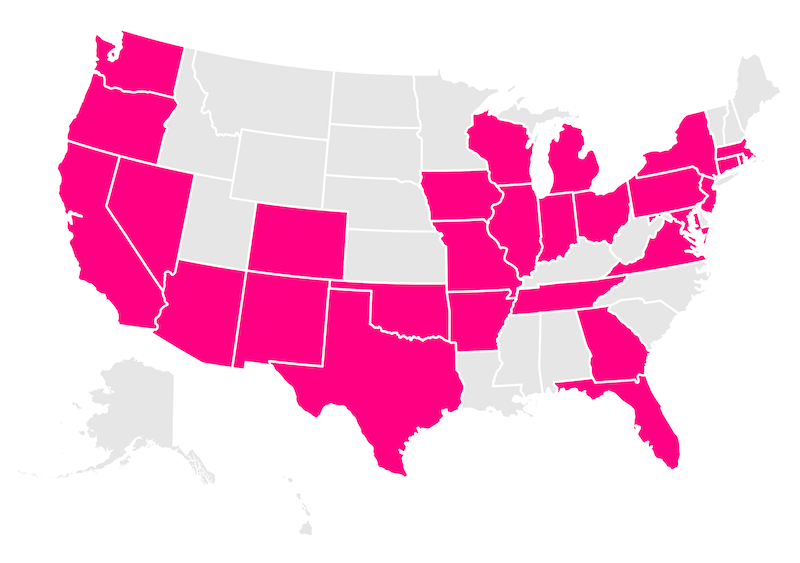

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.