If thinking about homeowners insurance has you breaking out in a rash, you’re not alone. You’re already figuring out a mortgage, and dealing with a stack of contractual paperwork—so you’re probably feeling all kinds of stress.

But home insurance doesn’t need to be complicated. You need it to protect your new home. And if you have a mortgage, it’s actually a requirement.

Think of it this way: Your mortgage lender is basically a co-owner of your home. It’s in their best interest to keep your new home in shape. If the worst happens, and you’re insured, you’ll have the funds to take care of it. Otherwise, you’ll be left with little to no mortgage value, and you (and your lender) both lose your asset.

Your home will be one of the most valuable things you’ll ever own, and homeowners insurance makes sure your property is protected. To get started, here’s what we’ll cover:

Is a cheaper home insurance policy actually better?

What makes a homeowners policy unique to you?

Can I get a discount on my policy?

Is a cheaper home insurance policy actually… better?

When it comes to actually purchasing homeowners insurance, should you be settling on whichever company comes through with the lowest home insurance quote? When we go out clothes shopping, it’s easy to compare a cashmere sweater versus a polyester one, but how do we compare high-quality home insurance policies—especially when there are so many home insurance companies to choose from?

The average cost of homeowners insurance in the US is $1,445 per year, or $120 a month, according to Value Penguin. But to really understand how to pick a high-quality but well-priced insurance policy, let’s back up a little, and actually explain how home insurance companies work—and what you’re getting for your money.

Old insurance versus new

If you need reminding, a homeowners insurance policy is a contract between you and your insurance company that covers you in a bunch of different situations. It protects you and your home if bad luck leaves you recovering or repairing damages.

There are a bunch of different homeowners insurance companies to choose from, and most of them provide pretty similar coverage options. (FYI, homeowners insurance has six main coverage areas. Find out exactly what’s covered by your home insurance policy.)

It’s helpful to understand that there are essentially two common types of insurers: traditional, and insurtech. And then there’s Lemonade.

With a traditional insurance company, the process of purchasing insurance will be more old-fashioned, likely more expensive, and probably less efficient. You’ll need to get in touch with an agent, who will help you determine what type of insurance coverage you need. They’ll eventually provide you with a home insurance quote, either over the phone or in their office. Some people might appreciate this experience since it’s deep-rooted and familiar—and hasn’t changed much in decades.

What about so-called “insurtech” brands? These are companies that, as the name implies, incorporate newer technologies in order to evolve the industry. But the vast majority of insurtech companies aren’t proper insurance carriers; instead, they offer policies that are written by other firms.

And then there’s Lemonade. What makes Lemonade different? For starters, we underwrite our own policies and are reinsured. Lemonade’s AI-powered bot Maya, is designed with underwriting algorithms in place, which means most customers are able to get insured instantly. These bots give Lemonade a distinct advantage in terms of precision when it comes to writing policies.

Traditional insurance companies have large overheads because they need more employees, and therefore they end up charging customers higher premiums. Because of AI and machine learning, Lemonade has lower overheads and can offer homeowners insurance policies from just $25/month. Plus, Maya’s a bot, and she never takes a cut when she sells a policy. She’ll also ease you through the sign-up process and ensure you’re getting the coverage you need, lightning-fast.

App-based insurance like Lemonade also makes your post-purchase experience more convenient. Need to add your spouse’s name to your policy? Got a new credit card, or switched banks? No problem. Take care of everything in seconds right from your smartphone. With Lemonade, you can even use our app to file a claim—and get paid within seconds.

Cheap versus pricey

21st-century companies like Lemonade are generally cheaper than their older competitors. Why? Consider this: traditional insurance companies like State Farm or Allstate employ around 19,000 independent agents to service their customers, while virtually every single policyholder at Lemonade is on-boarded by AI Maya.

We have about 1 employee per every 2,353 policies—whereas State Farm has about 1 employee for every 1,095 policies. In other words, State Farm needs to hire more than twice as many employees to handle each policy, and that cost is likely passed on to you. At Lemonade, less overhead for us means more savings for you, plus a much faster sign-up process.

Customer satisfaction

With traditional insurance carriers, you might get some one-on-one attention, either in-person from an insurance agent or over the phone, but it’s unlikely they’ll give you a quote on the spot. You’ll also have stacks of paperwork to sign.

Lemonade relies on tech and AI to change the field, but that doesn’t mean we’ve forgotten how important a human touch is. While AI Maya expertly handles more than a quarter of all basic customer inquiries, we know the value of personalized interactions. Because Maya takes care of the small tasks, it frees up our (human) support team to help with particularly complicated insurance questions, like how to replace a lost engagement ring.

What makes a homeowners policy unique to you?

When it comes to your customizable policy, the insurance premium on your Boston townhouse won’t be the same as it is for your brother, who owns a mansion in Georgia. Why? Well, the price of homeowners insurance can vary significantly, depending on factors like a home’s condition and location, as well as a policy’s deductible, and the amount of coverage you need.

Here are the top 3 factors that influence the cost of your homeowners insurance premiums the most.

- Weather conditions in your state. States with a higher chance of natural disasters generally have higher premiums than states that don’t. For example: Louisiana, Texas, Florida, Oklahoma, and Kansas have the highest premium for homeowners insurance. It’s no coincidence that Florida, Texas, and Louisiana are coastal states and can encounter some pretty crazy storms, and Oklahoma and Kansas are bang in the middle of Tornado Alley.

- Materials your home is built with. The more likely your home will crumble due to a natural disaster, the more expensive your homeowners insurance will be. This takes into account everything from the materials used in your roof, and even the shape of your roof.

- Loss history in your neighborhood. Since homeowners insurance also covers the things you own, the likelihood of your stuff getting stolen will also define your risk.

Does coverage affect price?

Definitely. Insurance coverage is like a really good umbrella. It protects you from a range of bad things that could happen to you, your stuff (aka your personal property), or your house (this falls under dwelling coverage, in coverage lingo).

Let’s say in total you own $10,000 worth of stuff, including your trusty bicycle, and several crates of vinyl that your Uncle Bob gifted you. Meanwhile, your friend Gigi has a drool-worthy collection of vintage guitars that she inherited from her dad, former frontman of the heavy-metal band Named Perils. Won’t the extra coverage Gigi will need for those pricey instruments affect her premium?

It sure will. Gigi will have to pay a higher premium. That’s because, in the worst-case scenario—let’s say someone robbed her house while she was on vacation—Gigi can then use her policy to claim back the value of those vintage guitars.

And it’s not just the stuff you own. The value of your home itself, of course, also affects the price of your policy. If you live in a $2 million mansion, you’ll need to pay a higher monthly premium to account for the cost to rebuild your house in the event of a disaster.

There are six broad areas of coverage for homeowners insurance, including liability coverage. It can get complex, but we want to make sure you understand everything. Do you want to figure out how much you’ll need across each category? Check out our handy guide here.

Can I get a discount on my policy?

It depends! There are only a few ways to get a lower price on your home insurance policy.

Here’s an easy one: If you have a smoke detector, fire alarm, or a burglar alarm you could qualify for a discount. That’s because we love Lemonaders who keep their home safe (and hey, that means less risk for us, too).

Here are a few other factors that could impact your policy price (they’re generally things that will make it more expensive, not less—but bear with us for a sec).

- Extra Coverage. If you schedule personal property coverage on your high-ticket items, you’ll pay a bit more for those specific, valuable items.

- Claims history. If you have filed claims in the past, your price will usually increase only if the approved claim is at least $500 above your deductible, or the incident was within your control. For example, let’s say you file a claim for your $500 headphones with a policy that has a $250 deductible (in which case Lemonade pays out $250), or for a wildfire that destroyed your house (which isn’t in your control). Your price shouldn’t increase due to that claim.

FYI, it’s not just your own past behavior. If the previous tenant of your apartment filed 300 theft claims it could affect your policy, since your home is more likely to be broken into.

Okay, so those are all things that will make the price of your homeowners insurance climb. But we’re not saying you should skip Extra Coverage, or avoid filing a claim if you need to. Insurance is a safety net that’s there in case the worst happens to you, your stuff, or the people living with you. Cutting a hole in that net just to save a few bucks a month probably isn’t worth it! But ultimately, the choice is yours.

How do claims work?

This is where it gets interesting. Traditionally, if you had homeowners insurance and you needed to make an insurance claim, you’d have to get in contact with your insurance company, listen to hold music for about 20 minutes, and answer a whole host of questions. Then your insurance company might try hard to find reasons to deny your claim. After all, that money could have gone straight into their pockets.

That’s where Lemonade is different. We take a flat fee from your insurance premium, use the rest to pay claims, and give back what’s left to causes you care about. We gain nothing by delaying or denying claims, so we handle them quickly and fairly.

This also impacts loss cost. While AI Maya is the helpful bot who gets your policy off the ground, AI Jim is the one who handles, investigates, and settles claims. He saves our Claims Experience Team 58,246 hours per year by using anti-fraud algorithms, claim data aggregation, and instant claims.

Ready to buy?

When comparing homeowners insurance rates, compare each and every policy detail before making a decision, including deductibles, add-ons, and coverage limits. Sure, price is important, but there’s no point in purchasing a cheap policy that doesn’t offer you peace of mind. In our extremely unbiased opinion, we think that Lemonade would be a great fit—but don’t just take our word for it. Play the field, get quotes from a few different companies, and then you’ll be ready to make a confident choice. Naturally, we’re a little biased, but ultimately what matters is searching for the right homeowners insurance for you (not your fancy friend Gigi). Why not give Lemonade a spin?

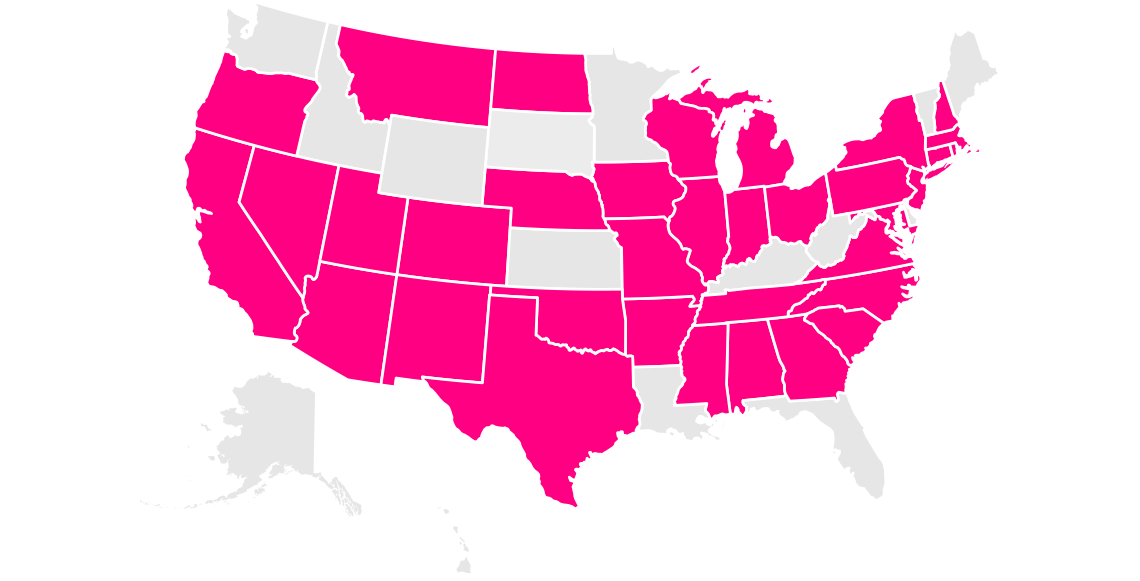

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.