Imagine this: Your adventurous Akita “Milo” swallows something they shouldn’t have on a hike and requires emergency surgery to remove it.

With pet insurance, you can have peace of mind knowing that something like a costly procedure (and so much more) could be reimbursed, allowing you to focus on your pet’s well-being, rather than the financial burden.

You already know your pet deserves the best, and this article will help you understand what pet insurance is, how it works, and explain the ways Lemonade’s pet insurance is different.

Here’s a quick preview of what we’ll be discussing:

What is pet health insurance?

What does pet health insurance cover?

How can you customize a pet health insurance policy?

How much does pet health insurance cost anyway?

How do pet insurance claims work with my vet?

How can I get Lemonade cat insurance or dog insurance?

What is pet health insurance?

Caring for a pet is actually really expensive, and the costs of veterinary care are rising. You could suddenly be hit with expensive emergency care or exam fees. Not to scare you, but a pet health insurance policy could be the difference between being able to afford to save your pet’s life, or not.

If an accident or illness means you’re left with an expensive vet bill, your insurance would reimburse you for parts of the cost of what your pet needs to get better. A standard pet health insurance policy will help cover the costs of diagnostics, procedures, and medications to treat your dog or cat’s eligible accidents and illnesses. (more on all of that later!).

You may be familiar with some of the basic terms already, but we’ll unpack them anyway… here’s what you really get with pet health insurance:

What does pet health insurance cover?

If you’re short on time, here’s a handy cheat-sheet on Lemonade Pet Insurance coverages:

| Treatment | Usually covered | Sometimes covered | Never covered |

|---|---|---|---|

| Diagnostics | √ | ||

| Injury from accident | √ | ||

| Cancer | √ | ||

| Pre-existing conditions | √ | ||

| Dental cleaning | √ | ||

| Vaccinations | √ | ||

| Flea & heartworm prevention | √ | ||

| Flea & heartworm treatment | √ | ||

| Allergy medicine (like Cytopoint and Apoquel) | √ | ||

| Physical therapy | √ | ||

| Arthritis medication | √ |

A basic pet health insurance policy covers the costs of diagnostics (like x-rays or blood tests) and treatments (like surgery or medication) for accidents and illnesses. Different insurance companies will offer different options, so you may have to do a bit of digging to figure out what the best pet insurance for your furry family member is.

When you’re shopping around, consider what kind of medical expenses your pet already faces, and what kinds of things are worth getting insurance coverage for. Some pet parents may decide that an accident-only plan is right for them, while others may want to make sure they’ll be reimbursed for preventative costs, like vaccinations, that can help to prevent their dog or cat from developing an illness. Also, it’s important to consider additional potential costs like vet visit fees and physical therapy, which are not included in basic accident and illness coverage. (We’ll deep dive into these types of coverage a little later.)

A Lemonade pet health insurance policy is an open-peril policy, which means pretty much everything is covered, unless it’s specifically called out as not covered. So, it’s really important to know what’s not covered by pet insurance.

How can I customize a pet health insurance policy?

Different pet insurance companies will offer different kinds of coverage for your pet’s medical care. At Lemonade, we’ve got a few different ways you can customize your policy.

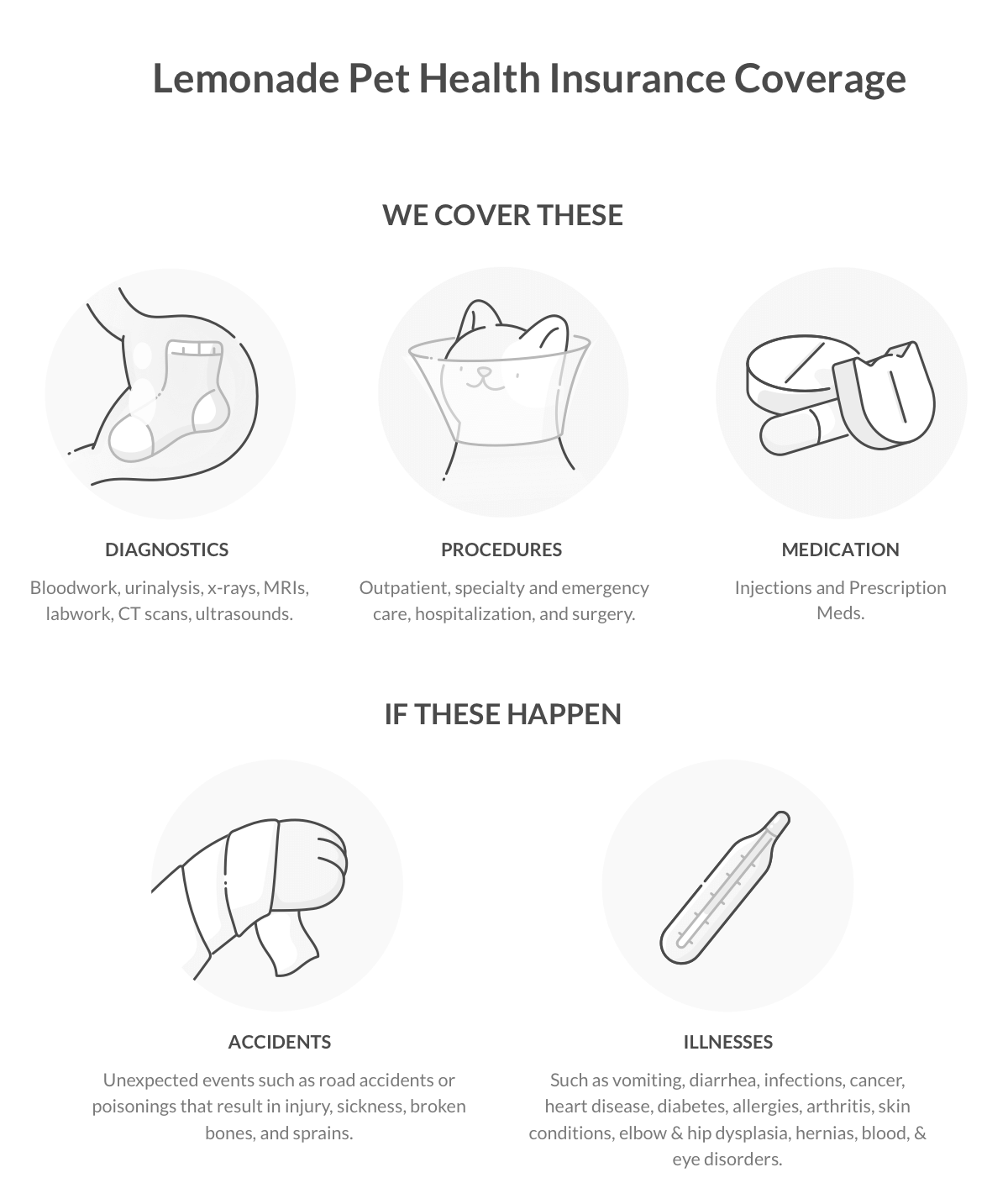

For starters, a basic Lemonade pet health insurance policy will cover your dog or cat for the following, in the event your pet has an unexpected accident or illness:

- Diagnostics: Blood tests, x-rays, MRIs, CT scans and lab work

- Procedures: Outpatient, specialty and emergency care, hospitalization, and surgery

- Medication: Injections or prescription meds

So, if you’re hit with expensive vet bills if your pet needs to undergo cancer treatments, you’ll be covered. Same goes for broken bones, allergies, ingestion of toxic foods, and more. Of course, this coverage isn’t totally unlimited, which is one of the reasons we offer optional add-ons to your policy, like vet visit fees, physical therapy, dental illness, behavioral conditions, and end-of-life and remembrance, as well as three great preventative care packages to help extend your coverage and you build the perfect policy for you and your pet.

Lemonade’s Preventative Care

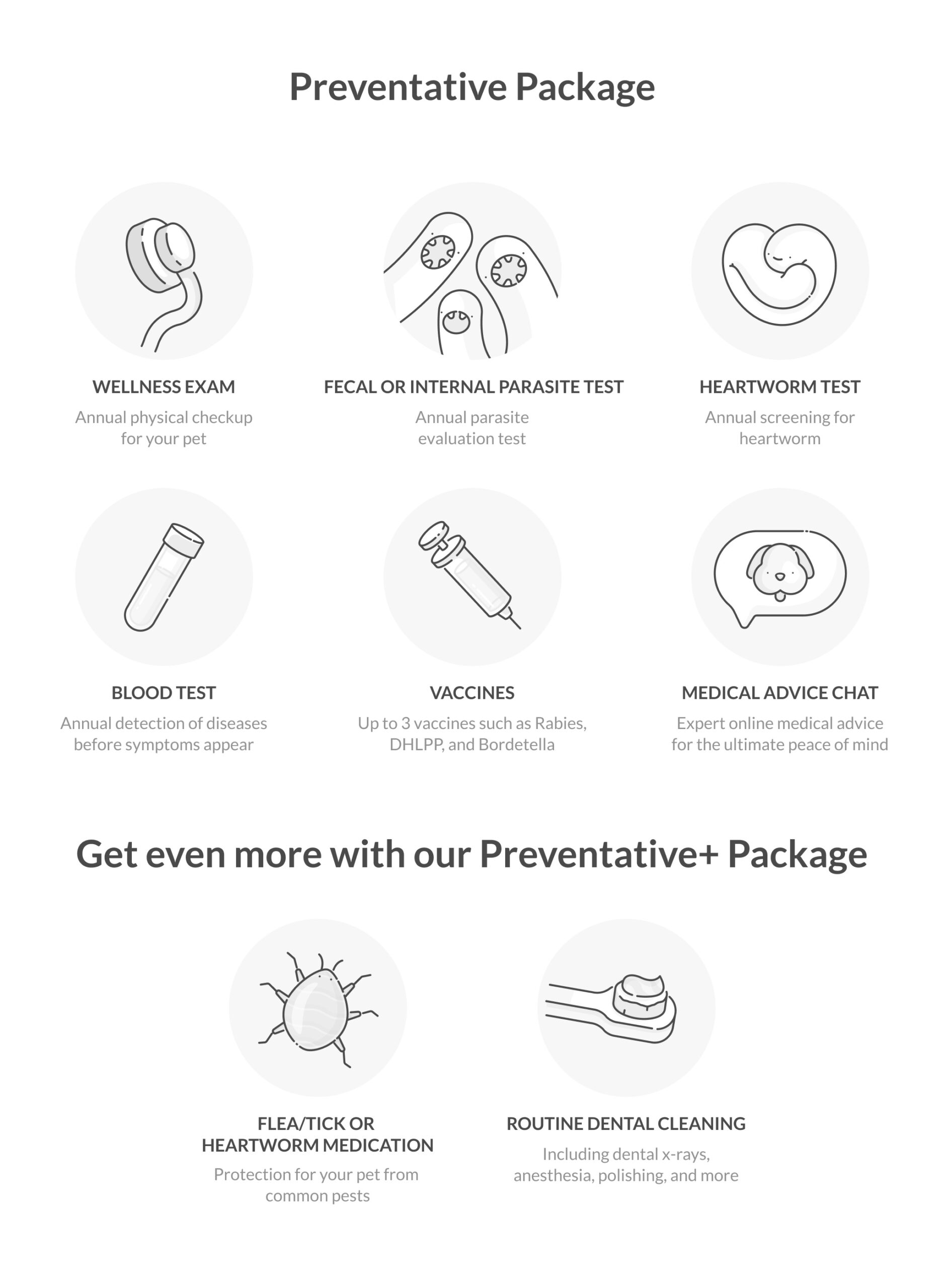

While a basic accident and illness pet health insurance policy will cover you for the unexpected things in your fur fam’s future, adding preventative care to your coverage can help with expenses you’re already spending on. You’re probably already paying more than the cost of our Preventative package for your pet’s ongoing health care, and by adding it to a Lemonade pet insurance policy you’ll be covered for all kinds of things that help keep your pet healthy—like your annual wellness exam, blood tests, vaccines, and more.

As a bonus, we’ll even give you chat access to our pet health experts.

Lemonade’s Preventative+ package

Want to get even more for your pet? Lemonade’s Preventative+ allows us to reimburse you for heartworm or flea/tick medication as well as routine dental cleaning.

Puppy/Kitten Preventative package

If your furry friend is under 2 years-old, we’ve designed the Puppy/Kitten Preventative package for puppies and kittens, made especially to provide young pets with the care they need to stay healthy. It includes coverage for 2 wellness exams, 6 vaccines, 2 fecal or internal parasite tests, spay/neuter, microchipping and heartworm or flea/tick medication. Basically, all the major things your pup or kitten needs to grow to healthy!

Lemonade’s Add-ons

If you decide not to add preventative care, you can still select to include stand-alone add-ons to help pay for other costs of taking care of your pet.

Lemonade pet insurance offers five optional add-ons that you can mix and match on your policy. Here’s what they can help cover:

- Vet visit fees. Fees vets might charge for their time and labor when you bring your pet in after an accident or illness.

- Physical therapy. Physical therapy, acupuncture, and hydrotherapy to help your pooch through the recovery process.

- Dental illness. Procedures like tooth extractions and root canals, and treatments for things like gingivitis and periodontal disease.

- Behavioral conditions. Vet-recommended therapy and medications for behavioral conditions like anxiety and aggression.

- End of life and remembrance. Vet-recommended euthanasia, as well as cremation, and commemorative items to memorialize your pet.

You can also customize the payment structure of your pet insurance. It’s easier to explain that by looking at what a pet health insurance policy costs. Ready?

How much does pet health insurance cost, anyway?

A Lemonade pet health insurance plan starts at $10/month for both cats and dogs, but there are several factors that can impact how much your monthly premium will be.

Dog insurance tends to be more expensive than a policy for a cat, and some breeds will cost more than others. Your pet’s age and where you live can have an impact on the cost of pet insurance too, so the best thing to do is shop around and compare pet insurance quotes from several different insurance companies.

Don’t forget that you can customize your pet insurance plan by adjusting your co-insurance, annual deductible, and annual limits to customize insurance coverage to give your pet the care they need (and to help lower your monthly premium).

It’s true: The lower your co-insurance or annual limit, the less you pay per month, and choosing a higher deductible will also keep your monthly price lower. But don’t forget that a lower price will mean less coverage when an expensive vet bill rolls in.

How do pet insurance claims work with my vet?

Since Lemonade Pet works on a reimbursement basis, you can visit your pet in any vet you like in the U.S., as long as they’re licensed to provide veterinary care in the state they operate in.

You’d pay the bill for your pet’s care or treatment upfront, then submit those receipts to us in the Lemonade mobile app for reimbursement. Our claims team will review to make sure the situation you’re claiming is covered under your policy, and reimburse you for the amount you’re eligible for on the claim.

How do I get Lemonade cat insurance or dog insurance?

Remember how quickly you fell in love with your pet, within minutes of first snuggling them? That’s about how long it’ll take to sign up for a Lemonade pet health insurance policy…

Click the button below, or get started in our mobile app on your iPhone or Android. From there, Lemonade’s friendly AI chatbot, Maya will ask you a few simple questions about your four-legged friend so you can lock-in the best pet insurance to cover your pet—and your wallet.